50 Fintech Experts Share Industry Predictions for 2023

As 2022 comes to an end, here’s what you should expect from the fintech industry in 2023.

Fintech is hurtling into 2023 along a rocky road. 2022 tormented the industry with a rock slide of setbacks such as crashing valuations, the cold harsh winds of the cryptocurrency winter, funding free-falling to worse-than pre-pandemic levels, regulators rushing to introduce more red tape to cut through, and companies collapsing at a catastrophic rate. Financial services innovators are seemingly standing on shaky ground.

The situation is dramatically different from how 2021 ended. As fintech firms found themselves heading into 2022, they were coming out of an all-time high. Covid-19 had set off a bull market. Stocks skyrocketed, investment flooded in and bitcoin was trading at an all-time high. Businesses eagerly met the new year with anticipation, hiring en-masse to meet projected record demands for their services. However, the first few months of 2022 swiftly dissuaded them of any delusions that those dreams were anything but fantasies.

Their victory lap has become a painful marathon. One of the first signs that a weather change was coming originated with the Federal Reserve. When the US central bank hinted at the beginning of the year that it would start to raise interest rates and indicated a dialling back of its aggressive bond-buying programme, it flagged to the market that it was expecting a downturn.

Russia’s invasion of Ukraine exacerbated the situation. The illegal invasion raised fuel prices. It also threatened to cause a worldwide food shortage and spill over into other nations either via fighting on the ground or on the internet – saying nothing about the risk of human suffering and deaths.

Fintech funding falling

These factors and others had palpable consequences. Investors responded by becoming more cautious. Fintech firms found that funding started to dry up as a result.

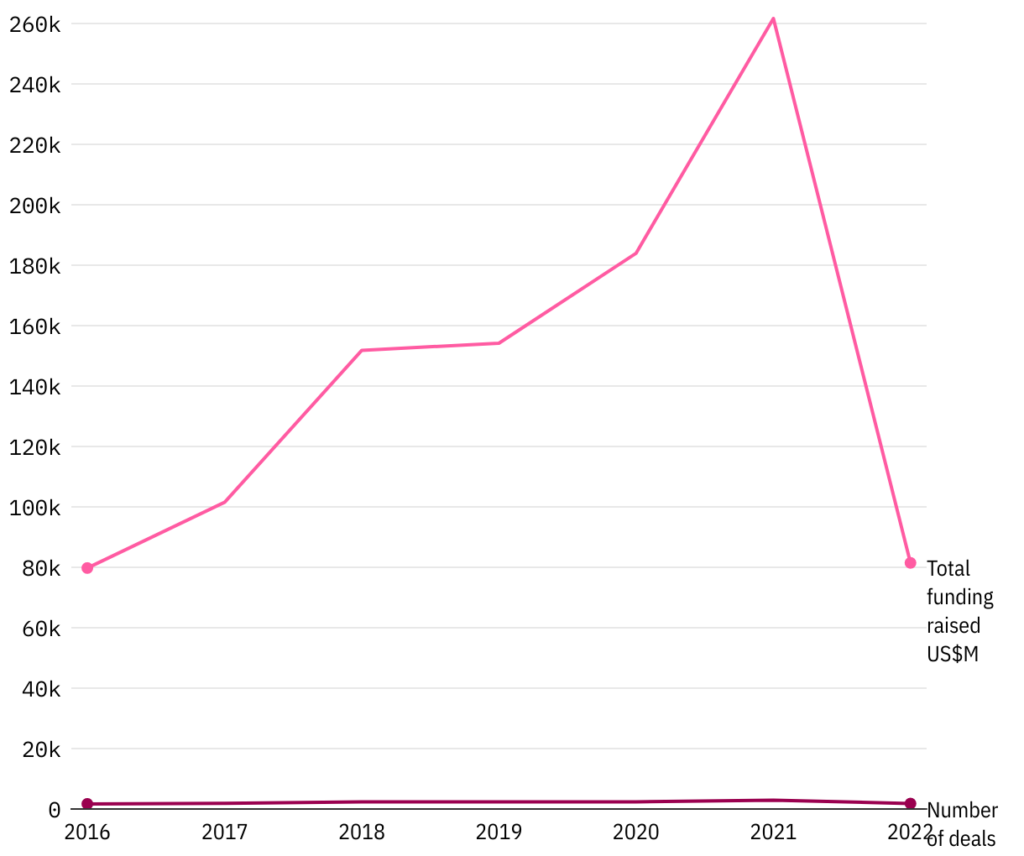

Over the course of 2022, cash injections into the fintech industry have plummeted to below pre-Covid-19 levels. Back in 2016, investors put $79.7bn into the fintech industry across 1,697 venture financing, equity offering, private equity and debt offering deals, according to data accessed from research firm GlobalData on December 9.

Those figures jumped over the next few years. In 2021, backers invested $261.7bn across 2,923 deals. However, funding has dried out in 2022. As the year is coming to a close, financial services innovators have only secured $81.4bn in new capital across 1,798 deals, according to GlobalData.

Deals dropping weren’t the only challenge the industry had to deal with. Rising inflation also meant people had less money to spend. Consequently, they didn’t use fintech companies’ services to the same extent as they had over the course of the coronavirus crisis.

Falling funding and demand meant fintech firms had less money. The resulting bloodbath has been brutal. Just like the overall tech sector, financial services innovators have been forced to lay off staff, close overseas operations or collapsed all together – in some cases like with cryptocurrency exchange FTX, due to to scandals and public scrutiny exposing how weak their business models really were.

It is against that backdrop that the fintech industry is heading into 2023. However, when Verdict reached out to 50 experts from around the fintech community to hear their insights and predictions for the new year, they responded with cautious bullishness.

The experts include representatives from tech giants like IBM, payment paragons like AliPay and a range of founders behind some of the most innovative fintech startups out there as well as the investors backing them.

To understand their confidence, it’s worth remembering how widespread the fintech industry actually is.

The fintech industry will start 2023 on a rocky foundation

The fintech industry is a sprawling network where each segment caters to one specific user need. You have neobanks, banking as a service (Baas) startups, embedded finance ventures, buy-now-pay later (BNPL) enterprises, regulation technology (regtech) businesses, open banking firms, cryptocurrency companies, insurance innovators and a plethora of other players – each catering to a particular need.

However, separate as they may seem at a glance, they have all been affected the different trends that have swept across the industry in 2022.

Going into 2023, fintech firms will continue to have to look over their shoulders as both Big Tech firms and financial services giants are moving into their turf.

Then there’s the regulatory rallying call for tougher policing of different aspects of the fintech sector in order to better protect users.

There have been plenty of setbacks in 2023 as well. The collapse of cryptocurrency giants like FTX, BlockFi and Celsius have rocked the confidence of bitcoin-based businesses. Despite this, several of the fintech experts we spoke to not only believed cryptocurrencies will continue to flourish, but also that we will see an emergence of more central bank digital currencies (CBDC) projects in 2023.

Then there’s the question of how new technology trends – such as the metaverse, Web3 and the ongoing artificial intelligence (AI) revolution – will transform the industry.

Despite the challenges on the horizon, executives at German neobank N26 and payment giant Alipay seemingly share a sense of optimism about where the fintech industry will go in 2023

Some, like Saxo Bank founder Lars Seier Christensen, believe the implosion of companies like Fast will be good for the fintech industry in the long run. They believe it will ensure the companies in that survive will be more resiliant, meaning the sector will be stronger as a result.

So, with all of that in mind, let’s find out why the 50 fintech industry stakeholders we’ve spoken to believe Web3 will become a dirty word, ponder about the role of the metaverse, worry about the role of deepfakes, celebrate the growing use of AI, and predict where money will got next, as well as what else they think will happen to the sector in 2023.

Magnus Larsson, CEO and founder, MAJORITY

2023 will be the death of many specialised neobanks. Looking at the initial wave of neobanks, the majority have become country-specific bank challengers such as Chime in the US, Monzo in the UK, Lunar in the Nordic countries and N26 in Germany.

A second wave of more verticalised neobanks have emerged. This includes Greenlight and Step for kids and teenagers, Current for the LGBTQ+ community, Kinly and Greenwood for African-Americans, SABEResPODER and Fortu for Hispanics and MAJORITY as an immigrant-focused banking subscription with various international resources.

This year, the financing situation has changed drastically. Valuations have dropped significantly, especially in the fintech space, with a general negative sentiment towards fintechs and many of them losing up to 80% of their valuations. We are now seeing many neobanks have had to scale down or close; in the last few weeks we saw Stilt closing shop, and that trend will continue next year.

The question is how will the future emerge? Banking is for sure a massive market and there will likely be a number of winners, but in order to survive, I believe there are a few things that you can’t cheat. You have to have a real customer problem to solve; you need a target group that is big enough to build a large business; you must have a revenue and margin model that works; and you need to have a customer acquisition strategy that isn’t built on spending all your money on Meta and Google.

The winners will be more obvious next year, as investments will mainly go to the companies that can show the above and prove to be relevant through turbulent times.

Alexander Weber, chief growth officer, N26

More than ever before the outlook for fintech in 2023 will be dictated by external factors and ongoing economic uncertainty. In this context, the resilience of each company’s business model will be decisive; propositions with diverse revenue streams will be better positioned to absorb external shocks and to thrive.

Banks played a large role in the 2008 Financial Crisis. Since then, and off the back of that, the space and its regulators have evolved substantially. N26, like many other financial technology companies, was born in the aftermath of this crisis to make things better.

Now, there is an opportunity and a requirement for neobanks to make good on this promise. In difficult times, they need to do everything they can to be a true financial partner, empowering consumers to stay on top of their finances and develop a positive relationship with their money.

But even with the overlapping crises we will likely experience in 2023, fintechs will still remain masters of their own destiny. To succeed, they must keep up the pace of innovation in spite of current headwinds. Customers’ needs are constantly evolving, and this is particularly true in times of crisis. So, I expect to see greater personalisation in both product and pricing in 2023 to reflect this.

Technology will continue to play an important role in breaking down barriers by making pricing more transparent, facilitating easier access to financial services, and promoting financial literacy.

Lily Shaw, investor, OMERS Ventures

After a year where use cases and utility were viewed as deeply unsexy, I expect these to be the focus for 2023. We continue to see unmet need within both B2B and cross border payments, which we anticipate will remain growth markets.

For example, we’re starting to see great teams building Orchestration 2.0 within payments, which has the potential to massively improve gross margin profiles through meaningful economies of scale. For instance, companies are moving away from positioning themselves as a tech player, to being the merchant of record and in the flow of funds. The team at Paytrix is a great example of one company pioneering this approach.

Pietro Candela, European head of business development, Alipay+

The big innovation trend we’re seeing at the moment is service integration; moving beyond technologies that are fragmented in terms of their payment capabilities and additional services. This is particularly the case for cross-border payments, whereby businesses should be looking to providers that do more than just facilitate this one element.

Cross-border payment acceptance should be the minimum functionality – particularly when looking to tap into the Asian market. Instead, businesses should be looking to technologies that allow customers to complete a transaction inside an app, instead of on a plastic card or NFC touchpoint, thus allowing users to enjoy an augmented experience before, during and after their payment. Further, it’s possible to get geo-localised promotions in real-time, verify the forex rate of a cross-border payment before the transaction, as well as experience a much more seamless end-to-end journey.

Ultimately, this kind of mobile-first strategy will be crucial in creating seamless, and connected experiences for new markets, with the payment serving as just the first touchpoint.

Oliver Yonchev, co-founder and CEO, Flight Story

In the fintech space, we are going to see regulation, consolidation, clarity and AI be areas of focus in 2023.

Regulation. Following the FTX saga and crypto crash of ‘22, we can expect to see companies, including both crypto and DeFi protocols, go through a serious regulatory overhaul. Some more mature DeFi and crypto companies will have already begun this process, but the organisations which are in their infancy or scaling up will be forced to comply or face becoming insolvent. These regulatory processes will extend into a standard of communication and marketing practices for DeFi and crypto assets and services, to protect both business and the market as a whole.

Consolidation. As a result of the macro-environment, we can expect to see a number of companies struggle in the year to come. This will mean there will be an increase in M&A to strengthen the position of larger companies. This will go in-hand with current day Web2 fintech powerhouses looking to expand their Web3 capabilities and product offering – for example, Stripe’s recent move into the crypto space. Businesses such as trading platforms and brokerages will start to diversify their platform capabilities to compete in de-centralised, saturated spaces, by adding value with new features, insights and content which drive community.

With many new terms circulating the fintech space this year, some will begin to embody a negative connotation – ie, Web3 will become a dirty word. Instead of pushing for the tech community to become mainstream, we will see the return of ‘the internet’ and ‘internet applications’ which will demystify and remove barriers which currently surround new digital technologies.

AI will play an increasingly important role in finance. For instance, we will start to see trading intelligence being implemented as a way to support retail investors. We will also spot further personalised and automated solutions in consumer banking products, and will see more context-based customer experiences through personalisation, powered by AI [and machine learning] tech.

Lili Metodieva, managing director, Monneo

It was probably long overdue, but after years of causing disruption within other sectors the world of fintech was disrupted itself in 2022.

At the beginning of the year, a downturn in investment capital into the sector was a huge source of concern. Thankfully, as the months have progressed the situation has begun to get a little better. However, I still don’t feel like things are totally back to normal.

Therefore, as we move into the new year, I predict we will see continued uncertainty across the fintech sector. It’s only anecdotal evidence, but very few of the businesses that I speak to seem to be excited for the coming year, which may suggest they are anticipating another tough 12 months. It’s easy to see why, businesses face several challenges right now, all of which seem destined to run into 2023, and possibly beyond.

However, there are certainly things to be excited about. The growth of ecommerce sales in recent times have been nothing short of staggering, and I see no reason why they won’t continue into 2023.

In the last two years, ecommerce sales rose from 15% of total retail sales to 21%. Analysts at Morgan Stanley predict the market has room to grow, expecting the sector to rise from its valuation of $3.3tn today, to over $5.4tn by 2026.

Make no mistake, this is also great news for fintech businesses. In the next few years, as online merchants receive and send more money from acquirers, suppliers, and partners, the need for truly frictionless financial solutions will become increasingly necessary. Thankfully, the fintech community can satisfy this need, with several incredibly relevant solutions already available, which will become more popular in 2023 such as Monneo.

Francesco Simoneschi, co-founder and CEO, TrueLayer

In 2023, it will become easier to pay in crypto, with more businesses supporting it as a payment method. To reflect this, we will see more and better crypto-fiat on ramp solutions making it easier for end customers to transact this way, with Stripe having very recently launched their offer in this space.

AI will continue to drive speed and optimisation in fintech and banking, with greater practical adoption in areas such as chatbots and customer service functions.

I expect to see more open finance use cases coming to market, using the power of Open Banking alongside a wider range of data sources. This will enable new partnerships to flourish, for example in variable recurring payments, which allow consumers to make regular payments for a product, service or bill, but in a much more frictionless and transparent way than was previously possible, using the technology that underpins open banking.

Intersecting with all these trends, embedded finance will mean that it will become easier for a far wider variety of non-financial businesses to offer financial services, and to set up their own offers in areas like BNPL.

Benjamin Chemla, co-founder and CEO, Shares

Over the last year, we’ve seen many banking and investment apps look to social media for inspiration – many have made a conscious effort to add social-first features to their platforms to attract a younger audience. We’re confident that this trend is not only set to grow in 2023 but become an incredibly important component of any tech company within the financial space.

With social first features comes the development of community. Fintech platforms and apps will see this sense of community becoming even more paramount and this will become an integral part of service offerings.

Traditional boundaries to investing have been lowered, meaning the incoming generation of investors are more confident in taking their first steps into the stock market. While this is fantastic and encouraging to see, there is a responsibility for financial companies to educate these younger consumers to make sure they have resources that’ll help inform their investing journeys. Creating and incorporating accessible educational resources is set to also be a major component of the user experience in the next year within this sector.

Within our own platform, we’ve seen data that reflects the mindful attitudes of individuals, who are opting to invest in companies that match and support their vision. This can be seen across a variety of industries and corresponding values; such as sustainability, female or minority founders, social causes and other sectors that prioritise social responsibility. To attract not only investors but customers, companies within the fintech space will have to champion these values and have the transparency to demonstrate their commitment to the cause.

It’s been a difficult year for investors and the trust they put in their investment platforms. Trust has always been critical in fintech, and we expect it to remain at the forefront of user decisions about where to store and grow their money. Trust signals will become increasingly important, and companies who prioritise this messaging stand to reap the rewards.

Martin McCann, CEO, Trade Ledger

2023 is probably going to be the biggest year of change for those in business and commercial banking for a generation for lots of reasons that are converging. Obviously there’s the macroeconomic environment; those challenges are well understood. But what’s less well understood is that we haven’t seen any change in technology, data or innovation in commercial banking for a very long time.

Now that’s changing. I think we’re going to see a new generation of technology and data enabled services in the next three years. As such, 2023 will be really important for those that want to deliver technically enabled and digital services in the banking for business space; this is the year that they must pay attention and be ready to make the move.

Yuelin Li, chief product officer, Onfido

Between the tapering of valuations and the increase in interest rates, the last year has indeed been tough for fintechs and the tech business at large. Innovation will continue, but businesses which are heavily dependent on zero or low interest rate financing costs – such as [the BNPL] space – may have a tough year.

On the other end of the spectrum, financial institutions are generally slower movers, and their digital transformations are a multi-decade process.

We expect that many of these companies will seize this point of instability to acquire some high-flying fintechs and their attractive customer profiles, at more attractive prices. Additionally, businesses that benefit from holding balances will likely see more investment opportunities come their way.

Prakash Pattni, MD for financial services digital transformation, IBM

The fintech space has gone through immense changes in recent years, with the emergence of new business models and services in areas of rising demand, from digital assets to mobile banking services. At the same time, new offerings and collaborations between fintech and banks have created new areas of risk, attracting the attention of financial regulators. In 2023, we could see increasing regulatory scrutiny and this is where hybrid cloud capabilities and industry clouds will have an important role to play. Industry-informed and standardised built-in compliance and security controls can make specialised cloud platforms vital to reduce risk throughout the industry, particularly to help facilitate secure and compliant collaboration between fintechs and banks.

In 2022 we also saw an increasing focus from both consumers and financial institutions in tracking energy usage and environmental impact. Measuring progress towards sustainability goals is top of mind for financial services businesses, which need to share this data to meet regulatory requirements and keep stakeholders informed. As a result, there is going to be a larger focus on technology that improves energy efficiency across entire IT operations without sacrificing security or performance. Banks and fintech will look to a hybrid cloud approach to build and run applications on a smaller footprint and help reduce the carbon footprint, allowing them to optimise their progress towards environmental, sustainability and governance goals.

Another trend that is set to accelerate in 2023 is the shift from fintech services focusing mostly on the consumer-facing elements of digital banking, to solving deeper digital transformation challenges in the mid- and back-office systems of financial institutions. As part of this journey, we’ll see banks modernising further by making more strategic decisions about where to deploy their applications and workloads across their hybrid cloud platforms, leveraging mainframes and public clouds more seamlessly to speed up innovation and bolster security.

Paul Lehair, investment director, AlbionVC

The CFO tech space will continue to rise as finance teams are eventually getting more software built for them following what happened to other functions first, [such as] sales, marketing, HR [and] developer tools. These tools, especially for FP&A/cash flow management, should benefit from strong tailwinds with the downturn in 2023, which is leading to a renewed focus on accurate forecasts and cash efficiency.

New tools and companies will be built to make B2B payments (still largely offline) more digital and automated. The recession will serve as a catalyst to make B2B payments processes more efficient and cost-effective. As APIs continue to eat the world, more fintech processes and functions will be unbundled into API-first companies, which is also being fostered by the explosion of embedded finance in parallel.

We will see more M&A consolidation in fintech in 2023 as the fundraising market will continue its flight to very high quality assets, which will lead to many companies struggling to raise their next round and having to consider exits instead. Large and well-capitalised fintech companies should be able to purchase other companies at fairly attractive prices.

Luke Ladyman, COO and co-founder, Cheddar

Gen Z will change the scope of fintech technology. The last few years have been a rollercoaster ride for Gen Z to say the least. They’ve gone through a pandemic, lockdowns, a cost-of-living crisis and now a recession – arguably making them the most financially insecure generation.

2023 will see the rise in consumer experience expectations, ensuring that fintech technology works to remedy Gen Z’s financial and personal pain points. Expect to see services that are more tailored to help this generation save money whilst they spend.

Fintechs will [continue to] empower consumers to better manage their finances. The next year will see an increase in value and added incentives for consumers through prioritising money saving promotions, switching to new products and cashback opportunities when choosing where to shop during these challenging times.

Expect to see a renewed push for digital currencies and frictionless banking made possible by advances in Open Banking (the use of open APIs that enable third-party providers to build applications and services around someone’s bank), further placing emphasis on bank-agnostic tools that offer consumers more choice and personalised offerings. [We will also see a further] expansion of open banking across the UK, EU and perhaps an introduction to North America.

The UK currently leads the pack when it comes to the utilisation of open banking. The year ahead will see greater efficiencies when purchasing goods i.e., instant payments to businesses at a fraction of the cost of card payments.

With the likes of Canada now allowing businesses to charge for card payments, solutions that bypass these networks will come to the forefront of economies squeezed by rising costs.

Melba Montague, head of banking and capital markets, Genpact

Despite ongoing economic turmoil, the UK has managed to retain its dominance as Europe’s major financial centre and London, as the Silicon Valley for fintechs. While 2023 looks rocky still, fintechs are known for swift innovation – constantly adapting and reinventing themselves – and will ride this wave.

Access to capital will be a huge hurdle for rapidly evolving fintechs looking to continue their scaling journeys across the UK and beyond. The fintechs that capture their part of the pie will be those that focus on – and demonstrate to investors – one word: resilience.

Staying laser-focused on operational basics to prove their worth, especially as the world watches the collapse of cryptocurrency exchange FTX and [crypto lender] BlockFi. Investors will expect to see fintechs follow regulatory advice, lower their reputational risks, keep customers well-protected, and utilise innovative technology to accelerate and scale their processes and maintain compliance.”

There is also no doubt that regulatory complexities will increase in 2023. Take BNPL as an example. Its explosive resurgence has made it an attractive alternative to traditional spending this year, although not without its risks.

It will be imperative for fintechs to take the high ground and look for innovative ways to both educate and protect their customers whilst getting ready for regulations recommended by the FCA come into play in 2023. BNPL providers have made growth commitments to investors. They will be expected to keep those promises next year, as well as keep operations stable and their customers safe and secure.

Matt Davies, chief marketing officer, SEON

As we near the end of the year, we’re trying to highlight what the future of fraud might look like. Watching costs in an economic downturn is becoming more critical and reducing the cost of fraud is now becoming the most essential part of ensuring increased profit margin.

Right now, it feels like we’re moving into a new digital era, where the blending of online and offline personalities is more pronounced, and ultimately more complex. At the same time, there are now new technologies emerging, which have the potential to make online fraud more difficult to spot.

Solutions like deepfakes and AI chatbots are going to make it much harder for people to authenticate themselves online very soon. The combination of these two factors should concern people. We may quickly find ourselves in a world where it’s increasingly difficult to tell real and fake profiles apart. Unfortunately, we might begin to see the first signs of this in 2023, so it’s important people are prepared.

Fraudsters can easily pose as customers, but they cannot replicate the digital footprints and history of legitimate people as it’s not economical for them. The types, speed and sophistication of fraud attacks is advancing all the time, so the ability to help organisations reduce the cost of fincrime and help create a fraud free world is going to be a key talking point for the next few years. Everyone at SEON is very excited about rising to that challenge.

Similarly, when it comes to high-growth economies in emerging markets, such as those in the APAC and LATAM regions there’s been a longstanding challenge around individuals with minimal, or non-existent credit histories. In the past, this lack of data had undermined the efficacy of certain fraud prevention checks.

Louis Carbonnier, co-founder and co-CEO, Hokodo

I think embedded finance will continue to be a huge trend in 2023. Fuelling this trend is the fact that banks have slowly been losing their monopoly over financial services as tech firms, retailers and other non-traditional players create digital-first offerings that are more cost-effective and more efficient than the incumbent solutions. Off the back of this, another trend we’ll see is banks partnering up with more agile fintech firms to offer the services that they’re not capable of offering alone.

What else? With the recession, we’ll likely see an uptick in fraudulent activity – and innovative measures to combat it. Elsewhere, compliance and regtech will become even more important. Companies will place greater value on sustainability and corporate responsibility when choosing to buy from or partner with you. Fintech employers will need to learn how to retain the talent they’ve attracted, or face losing quality employees as trends like ‘the great resignation’ and ‘quiet quitting’ continue to gather pace.

I think my last point above around learning how to retain talent is going to be really important for moving fintech forward in 2023. The attitude of the workforce is changing as the number of millennials in key roles grows. No longer do employees just want a job, they now place vast importance on aspects of work like culture and development. And by culture, I’m not referring to table tennis and free fruit!

For many years, fintech companies have claimed to revolutionise financial services, but we’ve been doing this in a buoyant environment, backed by exuberant investors that only looked at the top line. Now, we’re about to undergo a litmus test that will determine which fintechs were actually creating value through the cycle. I don’t think we’ve hit the bottom of the cycle yet. The next months will be a real test of character for the fintech sector. Paradoxically, if I were an investor, I’d seek to invest now as valuations will be more appealing and it’s going to be easier to separate the wheat from the chaff.

Darren Westlake, CEO and co-founder, Crowdcube

We’ve seen how 2022 brought fresh volatility to a market that was already recovering from the throes of the global pandemic. Yet, despite it all, alternative finance had a strong year in 2022 and 2023 looks like it will continue to grow. What’s more, non-traditional forms of funding are increasing in popularity and accessibility for scale-ups and start-ups of all shapes and sizes.

Founders need to enter 2023 with an open mind and consider every avenue of funding they can – particularly as VC funding might well be harder to come by next year. And now that the Enterprise Investment Scheme has been extended, the tax relief to investors is sure to continue to serve as a powerful draw for many in today’s conditions. Businesses simply cannot afford to ignore the potential of this opportunity.

Liudas Kanapienis, co-founder and CEO, Ondato

The biggest corrections in fintech space happened in 2022 so I would expect 2023 to be more focused on stability and efficiency increase which might bring opportunities to new startups or existing market players to use them and rise. Also I believe new business models might come up, especially in credit space.

Alternative financing is expected to grow in the coming years due to the “expensive money” on the financial markets and rising interest rates.

Speaking of efficiency, I also believe there will be more AI-powered resources and apps in 2023. AI automation takes over the manual process, thus saving time, meaning that fintechs and traditional banks can save labor expenses and big budgets. As a result, data-driven AI will enhance capital optimisation. This year has shown how manual processes are not easily scalable, as banks around the world discovered when they have been overwhelmed by the unprecedented increase in sanctions imposed on Russia following its invasion of Ukraine.

Ed Halsey, the co-founder and COO, hubb

The advancement of financial technology, or fintech, has been exponential in recent years. We have seen a whole new world of opportunity open up for businesses and consumers alike. So, what does the future hold? Here are five [of my] fintech predictions for 2023.

Open banking is a term used to describe the practice of making data accessible to third-party developers. This could include transaction history, account balances, and other financial data. Open banking started as a way to promote competition in the banking industry and give consumers more control over their data. However, it quickly evolved into something much more. In 2023, open banking will start to be utilised to offer personalised and on-demand ancillary services such as real-time insurance.

Embedded finance refers to the integration of financial products into other non-financial products and platforms. For example, you may have seen “buy now, pay later” options when checking out online. This is a form of embedded finance. In 2023, we will see a whole new era of embedded finance within buying journeys, offering credit for even the simplest and smallest of purchases, which could become dangerously normalised during the economic downturn and recession.

Cryptocurrency is a digital or virtual currency that uses cryptography for security purposes. Cryptocurrency is decentralised, meaning it is not subject to government or financial institution control. Bitcoin is the most well-known cryptocurrency, but there are many others out there as well. In 2023, cryptocurrency will take a giant leap forward in adoption, but with a significant move towards tokens with utility rather than pure currency plays.

Blockchain is a distributed database that allows multiple parties to securely record transactions without the need for an intermediary like a bank or government institution. Blockchain has been talked about for years as a game-changing technology with endless potential applications. However, so far it has mostly existed in the theoretical realm due to issues such as scalability and lack of regulation. In 2023, forced migration from legacy technology will begin to make blockchain more feasible and take it out of the theoretical and into the practical stages of deployment.

In any business, there are always two competing priorities: acquisition and retention/servicing costs. When times are good and profits are high, businesses can afford to spend more on acquiring new customers; however, when times are tough efficiency gains become much more important. In 2023, we predict that the focus will shift from customer acquisition to efficiency savings around servicing clients. This could mean anything from automating manual processes to using artificial intelligence (AI) chatbots to handle customer queries outside of office hours.

The advancement of financial technology shows no signs of slowing down anytime soon. We can expect even more innovation and disruption in the next few years as we move closer towards open banking becoming the norm, embedded finance taking over, cryptocurrency going mainstream(ish), blockchain moving from theory into practical applications, and efficiency becoming more important than customer acquisition costs.

Delia Pedersoli, COO, MultiPay Global Solutions

Younger consumers like millennials and Gen Z have grown used to paying via non-credit and debit card methods. The rise of [BNPL] is a perfect demonstration with its popularity pushing retailers to adopt it as an option at checkout. Research from Student Beans earlier this year found that nearly half (42%) of 16-24 year olds have used BNPL services in the last 12 months.

As the popularity and familiarity of BNPL booms, consumers are also increasingly open to trying other alternative payment methods. This year we will see increased innovation in this area as payment providers and retailers look to launch new systems that improve the customer experience and boost loyalty. With the cost-of-living crisis set to get worse in 2023, customer loyalty will become a major battleground for retailers and fintechs alike.

New alternative payment methods that are beginning to arrive on the market have the advantage that they reduce the number of businesses involved in the processing of a payment. This has the dual benefit of allowing businesses to get their money sooner (in many cases instantly), while also having significantly lower processing fees. With lower fees, retailers can pass on savings to customers who use these new payment methods, helping them enhance the relationship with shoppers at a time when many are closely watching their spending.

Alex Mifsud, co-founder and CEO, Weavr

B2B embedded finance will take centre stage in 2023. At a time when businesses are under pressure to do more with less, embedded finance can unlock new efficiencies. B2B SaaS and other B2B digital businesses can take advantage of this need by enhancing their offering through financial service provision.

By using the rich data that such B2B players collect and process for their business customers, they are able to offer relevant financial services such as payment optimisation, efficient collections and lower risk lending at the point of need.

In doing so, B2B SaaS and digital businesses have the opportunity to add significant new revenue streams from their existing customer base – in other words, increasing their revenues without the need to increase their marketing budgets.

According to recent analysis of the fast-moving embedded finance sector from Bain & Co and Bain Capital, revenue opportunities “will more than double from $21bn in 2021 to $51bn in 2026. The transaction value of embedded finance also will surge to $7tn by 2026 and account for 10% of US financial transactions”.

With this in mind, the embedded finance space is set to become increasingly crowded, with many vendors providing point solutions to emerging embedded finance challenges like on-boarding, monitoring and orchestration. However, only a small number of players who put together a well-curated range of financial services and tools, often by combining such ‘point solutions’ will be the ones that succeed.

Banks that have invested in [BaaS] will start to see their first challenges – [such as partnerships going wrong – with this approach to delivering embedded finance.

Finally, established players in the banking and payments landscape, such as the big banking tech vendors, and the card schemes will start to publish their own strategies and roadmaps for embedded finance.

Regulation and compliance [will also pay big role in the fintech industry in 2023]. Regulators will be more demanding of standards in embedded finance and this will force change in the way providers deliver it. Compliance-as-a-Service provision and adoption will increasingly displace the current BaaS model.

In addition, there will be increased M&A activity, partly as a result of the continued tough funding environment and partly because regulatory change will force providers to think about their ability to adapt. We’ll see continued consolidation as the bar gets higher due to stricter regulation and as funding gets tighter.

Tosin Eniolorunda, co-founder and CEO, TeamApt

I think in the next 12 months VC activity will start increasing, and we are already seeing signs of that with a number of deals being done.

The only thing that will sustain will be around longer timelines for investing as VCs will be keen on doing deep due diligence. Valuations will continue to be pegged to the fundamentals of a company, such as their unit economics, and there will be a focus on high quality transactions where the business models are proven.

We expect the tailwinds around cashless transactions will continue to drive the adoption and penetration of fintechs which fill a gap or solve pain-points for customers in these areas. In addition, regulators will be more keen to take on newer innovations – particularly those that are closely related to crypto, given the recent turmoil in the ecosystem.

Consolidation will start to happen in the fintech space in form of collaboration with banks, but also larger fintechs forming strategic partnerships with smaller ones.

Finally, and perhaps most importantly, fintechs must focus on customer experience to make sure they continue to protect their customers from any fraudulent activities in the months and years ahead.

Brian Hanrahan, CEO, Nuapay

In 2023 open banking will reach a tipping point in terms of consumer adoption. Recent research conducted by Nuapay found that one in four payments decision makers at merchant businesses think open banking will become the most popular payment method for customers by 2027.

When asked which payment method presents the most opportunities for their organisation over the next 3 years, Open Banking was the top choice (36%) among the merchants we spoke to, followed by digital wallets (35%) and [BNPL] (26%).

Embedded finance will also continue to gain momentum in 2023. The market is forecast to grow rapidly, with Juniper Research predicting that it will be worth more than $248.4bn by 2032, an astonishing growth from its current value of $54.3bn in 2022.

Embedded finance is forecasted to take off in the coming years. It’s clear to see why due to the various benefits that it provides – particularly when paired with open banking. All the convenience of integrated financial services plus the many, varied advantages of open banking – from cost reduction to improved data analysis opportunities – combine to deliver an unparalleled payments experience.

Giorgio Daher, UK sales director, Tuum

After a particularly turbulent 2022, which saw global financial uncertainty reach levels that we’ve not seen in decades, next year, we will undoubtedly see demand for banking services which help people better manage and save their money.

Our research earlier this year – before the worst of the economic crisis had even hit – already showed signs that people are adopting a more sensible approach to money – particularly younger generations. Over half of Gen Z we surveyed already have savings accounts despite many not being in the workplace yet. They also came out top as the biggest users of services like round-up savings pots, and were the generation with the most appetite for more budgeting tools from their banks.

Banking is becoming an even more integral part of people’s lives, and products/tools that help them transfer money among friends and family or split bills are strongly in demand – not just by the younger tech-savvy generations but also by older generations.

To be able to quickly devise and bring to market new banking services, banks and financial service providers need to have the banking technology that enables them to gather data and act on it. Most banks have or are in the midst of digitally transforming their tech stacks and product offerings to be able to offer new digital banking services but next year, the focus will go beyond digital transformation to digital acceleration.

Digital acceleration encompasses the next ag’ of transformation. Instead of banks simply digitalising existing workflows, digital acceleration brings the full potential of new digital capabilities into the very core of how banks do business. This requires banks and financial services providers to partner with third parties (including ones outside of financial services) through platforms. By doing this, they can both maximise the investments they’ve made in their own technologies while also tapping into the innovative capabilities of external stakeholders.

BBVA is a good example of a bank that is creating new products by embracing new technologies such as blockchain and teaming up with third parties; for example, earlier this year, BBVA collaborated with Bolsas Mercados Españoles (BME), the Inter-American Development Bank (IDB) and builders to launch the first blockchain-based regulated bonds in Spain. By looking beyond their own capabilities, banks can embrace new opportunities and extend their product offerings to be able to offer personalised and innovative services to customers – and grow market share.

We are already seeing the rise of platformification in the banking sector, 2023 will see digital acceleration come to the fore as an important phenomenon in the future of banking.

Andy Lyons, head of banking partnerships and solutions, Contis

In 2023 we will see more well-known consumer brands entering the financial services market offering white-labelled banking solutions like accounts, cards, and payments – all under the umbrella of embedded finance. These large consumer businesses will drive forward partnerships with third-party providers like insurers, lenders, and investment managers to capture more of the customer journey.

Rewards as a means of promoting loyalty will become more common, in the form of discounts at other merchants, cashback, or promotional offers surrounding the customers’ favoured product range. Embedded finance via open banking payments will also continue to gain traction and these payments mark a major shift that is extremely useful for consumers, given that this process requires little card or data entry.

But all innovations – especially in financial services – must take place within a regulatory framework. In 2023 I predict regulatory developments regarding SEPA instant payments – the mechanism which will allow anyone with a euro-denominated bank account to make an instant (within ten seconds) transfer. Meanwhile, the licensing process for crypto firms will become more onerous across the UK and Europe.

All this is leading to a world where businesses are more diversified, with a larger slice of each customer’s attention and spend. This will naturally lead to more boisterous competition, and those that aren’t adopting the embedded finance mindset could easily be left behind. In 2023, the global business that get ahead will be ‘not just’ retailers or online vendors – but integrated financial services firms offering customers better efficiency and value-for-money.

Nikhil Shah, founder, Polyhedron

The fintech landscape has transformed in recent years with the rise of BaaS. We’ve seen innovative collaboration with retail banking players like Starling and Holvi who have opened their API to benefit clients. And yet, this has not taken off for their corporate counterparts.

Why? There are myriad opportunities that could be solved; think about how approaches to payroll, a crucial permanent function, could be progressed into an entirely seamless experience for the modern employee. This could go as far as flexible pay, for example. Looking to 2023, as the appetite for BaaS has grown, so will partnerships between smaller corporate banks and fintechs to provide corporate clients with the products, services and comprehensive insights they expect to drive growth.

Andrew Tarver, founding partner and head of Motive Create, Motive Partners – Biog

Fintech will continue to go through a reality check in 2023, that reality being revenue and more importantly, profitability. Emphasis has swung towards running a viable business, or having a business plan which demonstrates a path to viability. This is a good thing, the survivors of this shake-out will prosper in years to come.

I also think there will be consolidation between the fintech community [and], more importantly, many more partnerships between fintech and incumbent financial institutions, think balance sheet meets tech.

Growth in the industry will focus on how tech supports fin. Innovations in technology, data intelligence, supporting increased flow of requests (think embedded finance), continued democratisation, expansion of tech enabled integration between participants and most importantly, we will start to see a new way to manufacture, and lifecycle manage financial products.

The headwinds will remain the guardrails of the industry, regulation, as they should be. 2022 has highlighted the fragility of the market and how innovative technology, left unregulated, can cause instability and losses to consumers. This needs to be addressed and 2023 will start to see appropriate controls put in place. Fintech requires positivity and belief to support greater adoption.

Fintech is all about changing the way someone interacts, someone processes, someone risk manages, someone integrates. Change requires belief and confidence in the ability of provider you are adopting. Any dent in belief, confidence or positivity will slow momentum, but as we see the true winners emerge, hopefully they will continue to fly the fintech flag for other entrepreneurs to prosper.

Matt Smith, CEO and co-founder, SteelEye

After a decade of growth and record fundraising in fintech, with fintech companies accounting for 21 of the UK’s 44 unicorns today, we predict that in 2023 we will see this slow down to a much more modest pace. Data from investment manager Finch Capital shows funding reached $6bn in 2020 and $19bb in 2021, but we have witnessed a 25% drop in 2022 so far.

The number of new fintech firms founded is down 85% since 2020. Market consolidation continues, and fintech M&A spiked in the first half of 2022, with 591 recorded deals. So, it is possible that we are now on the other side of the fintech sector ‘boom.’

Of course, the UK’s rich fintech ecosystem still presents exciting investment opportunities, and there is no shortage of available capital. But in the current economic environment, investors will be much more cautious about where, when, and how much they invest. The higher cost of capital coupled with a tougher business environment in general will force some fintech firms out of the market, as we have already seen, and create a smaller sector. Those who do make it through will emerge stronger and more resilient.

Before the pandemic, neo-banks and consumer-centric fintech businesses dominated the conversation. Now, amid recession fears and following a period in which fintech valuations fell faster than any other tech vertical, technology that powers back office and control functions is coming into focus. Tightening budgets and scrutiny of performance are driving this trend, and the financial services industry is under pressure to improve operational efficiencies while proving it has learned from past mistakes.

However, as the financial landscape becomes increasingly digital, so too does the risk of fraud, cybercrime, money laundering, data breaches, and market manipulation. In response, the RegTech market will continue to grow and evolve to meet the challenges of an ever-more tech-driven economy. SteelEye’s 2022 State of Financial Services Compliance report showed that almost half of firms (44%) are planning to invest more in regtech solutions in the next year.

James Lynn, co-founder, Currensea

The cost of living crisis is having an impact on everyone, even VCs. The funding landscape has altered with the industry already experiencing a drive to profitability where value is more sought-after than ever before – this will only accelerate next year. Where previously some fintechs may have been overvalued by investors based on potential or market trends, the sector is now seeing a return to investment basics and a focus on business fundamentals.

The fintechs that will thrive in the new investment landscape are those who can demonstrate a strong track record of growth and offer a solution that clearly delivers value for consumers at a point where household finances are under ever increasing strain.

Dave Lewis, CEO and founder, Ranqx

As a fintech we have a responsibility to provide a solution online that benefits all, a service which really helps people in society, and that ultimately benefits everyone. Small-to-medium sized businesses (SMBs) are the backbone of our economy, with small businesses making up 99.9% of total US businesses, according to Deloitte.

Despite this, access to working capital and lending to SMBs is a huge global problem, which needs significant improvement.

Likewise, in a post-Covid world, the so-called ‘covidpreneurs’, entrepreneurs who established their business during the pandemic are also finding it hard to access capital. Unfortunately, many of these businesses don’t fit long-standing lending criteria established by the banks decades ago.

Despite being decades old, many of these criteria have not evolved at all over time, which is leaving millions of businesses in the cold when it comes to accessing working capital.

This is where we could soon see real-time data driven digital insights technology start to swing the traditional reactive transaction engagement banks and credit unions have with SMBs, into proactive partnership relationships.

By leveraging alternative data sources when making lending decisions, incorporating a degree of science, and taking into consideration cultural and socioeconomic influences, these clever systems are helping to make SMB lending more accessible, efficient, frictionless, and will speed up the decision-making process. In fact, Deloitte’s 2019 SMB survey found that large and midsize banks often take over seven weeks to deliver a decision on a small business loan, compared to online, or alternative lenders that take between 24 to 48 hours.

In addition, Mambu found that 92% of SMBs are open to changing lenders for different or simpler digital support. As such, there’s now clear evidence to suggest data-driven lending systems are the future of SMB credit lending, enabling banks and credit unions to adopt more digital first approaches to their interactions with SMBs.

If you ask me, this is where we’ll really start to see traditional financial institutions accelerate fintech partnerships that begin to overtake ‘Technology Tourism’. As traditional banks realise the speed at which the fintech ecosystem is eating their lunch, the appetite to proactively partner with fintechs will accelerate. We’ll see traditional banking finally realise that the lengthy and costly internal build versus buying in of the expert technology that already exists, as a no brainer, working together to accelerate the deployment of digital products that meet market needs and benefitting everyone.

Brad Hyett, CEO, phos

In 2022, we’ve seen a growing interest in SoftPos. More retailers and merchants are beginning to understand the cost-saving benefits of serving a customer through a mobile application with Tap to Pay acceptance.

With Apple announcing their move into the space earlier this year, this is really going to drive both the awareness and the normalisation of SoftPoS. It’s a contributing factor to merchants’ acceptance of the technology as well as consumer understanding of it. These two aligning factors will only drive more curiosity in 2023.

PayPal and Venmo have also announced their support for Apple’s Tap to Pay functionality as it continues to roll out across new payment platforms and apps. With SoftPoS solutions now readily available for Android and iOS operating systems, merchants and legacy technology providers should be seeking to partner with a SoftPoS orchestrator to take advantage of the new technology and exponentially increase their acceptance points for contactless payments.

By working with a technology partner, businesses can avoid the high costs and time consuming nature of creating an in-house solution, resulting in faster speed to market and the agility to better respond to customer demand.

Robert Podlesni, CPO, Revolv3

Since the fintech industry covers a wide variety of financial verticals, including multiple market spheres, such as SaaS payments, we expect fintech to become even more nuanced and dynamic in what it can offer the world of finance. By incorporating both our digital and physical wallets to facilitate commerce and economic activity, fintech is expected to carry on with improving the way we transact, for both the B2C and B2B markets.

Fintech’s role as mediator between the physical and digital realm of the finance industry continues to be highly valued, especially as the boundaries are blurring. And since fintech offers more flexibility and versatility in how we bank, manage finances, and conduct commerce, the ability to move seamlessly between the physical and digital, or retail and ecommerce worlds, is evolving.

In 2023, we can expect to see a continued growth of financial inclusion. This trend is driven by innovations like Artificial Intelligence and Web3 enabling fintechs to deliver financial services at scale. We’re experiencing a greater selection of more flexible payment services, not to mention alternative financing, driven by financial software developments. Across fintech, the proliferation of use cases for machine learning and AI has also driven the need for more granular, cleaner, and consistent data that maintains compliance and privacy protections.

A greater migration to modern tech stacks is also expected. With looming economic recessions and stresses in overall collection rates, revenue and churn have pushed companies to embed financing options, payment alternatives, and increased vertical and horizontal reach. With the industry embracing alternative financing/payment models, increased visibility on transactions/payment performance and the impact companies are seeing from macroeconomic stresses are expected.

Werner Knoblich, chief revenue officer, Mambu

In 2022, we’ve seen a growing interest from Big Tech in finance, with the likes of Apple breaking into the space by introducing Tap to Pay and partnering with PayPal, it won’t be long before others follow suit. In comparison to fintechs, big techs have the reputation, technology and consumer data to help inform their strategy in the market.

However, as we’ve seen many times before, a crisis can lead to opportunity. For example, a fintech with a low valuation presents a great opportunity for legacy players that are looking to expand their digital offering and have the capital to leverage.

This year alone, we’ve seen a sharp rise in the number of mergers and acquisitions in the fintech space and the prime driver for this is increased interest rates and overstretched valuations of high-growth companies. This is likely to continue in 2023 as more opportunities arise and fintechs are seen as more of a friend than a foe.

We’ve seen established banks like JP Morgan acquire new fintechs like Renovite or launch a digital bank as they did with the launch of Chase in the UK. As such, it’s becoming easier for more traditional players to make big moves as there are fewer fintechs in the space and less competition. The advantage of spinoffs is you have more neo-banks who don’t need to ask for banking licences which have become few and far between.

In 2023, I believe fintechs and banks alike will partner more closely to adapt to the changes 2022 has presented. After all, agility in uncertain times is in a fintech’s nature and by design what they’re built to do.

Bala Kumar, Chief Product Officer, Jumio

Identity-related fraud will continue to pervade the sector in 2023, proving one of the biggest challenges financial services organisations will face. According to UK Finance, losses from card ID theft alone, where a criminal uses stolen or fake documents to open a card account in someone else’s name, increased 86% in the first six months of 2022 compared to the same period in 2021, from £11.5m to £21.4m.

With the cost-of-living crisis being felt, financial services organisations will need to do all they can to combat opportunistic fraudsters to protect their customers’ finances more than ever. Our recent global research found that over half of UK consumers (57%) would be more likely to engage with an online financial services provider if it had robust identity verification measures in place. Therefore, organisations should build on this consumer appetite in 2023 and truly embrace measures, like digital identity, as the only real and robust enough way to stamp out identity-related fraud.

Tim Annis, UK Managing Director, Bluechain

Merchants will struggle and be at greater risk of not getting paid in the next 12 months if they do not have an efficient and user-friendly digital payment process for their customers.

With two pandemic years behind us, the current economic instability and the increased cost of living, businesses must consider the impact on the everyday person. Almost eight million people in the UK alone are struggling to pay their bills, and there is an opportunity for businesses to improve the lives of these people with choice and flexibility in how they pay and get paid.

In 2023, we will also see a move away from credit as people look to spend the money they have, rather than the money they don’t have. This will support the growth of open banking and account-to-account payments, providing businesses with access to data faster to craft entirely new customer-friendly payment scenarios.

Direct debits are archaic. Secure bill-to-pay processes will help consumers pay in a way that suits them within terms and give businesses visibility of what is coming in and out. Unfortunately, this current cycle of pressure and inflation will not go down for a while, so the industry must help society regain control of its finances during uncertain times.

Leo Labeis, CEO, REGnosys

Over the past few years, regtech has emerged as one of the fastest advancing areas of financial technology and we should expect this trajectory to continue over the next 12 months.

Sector growth is particularly evident in regulatory reporting – a subsidiary of regtech in which 2022 saw several important developments. The amendments to the Commodity Futures Trading Commission’s swaps reporting rules (CFTC Rewrite) in December 2022 and upcoming changes to the European Markets Infrastructure Regulation (EMIR) in April 2024 – as well as updates to several Asia-Pacific reporting regimes – are part of a global overhaul of G20 trade reporting rules. RegTech is playing a central role in helping firms comply with the new standards.

The Digital Regulatory Reporting (DRR) programme provides a clear example of this. While regulatory reporting has long been mired by ambiguous and conflicting rules, DRR equips firms and their regulators with a shared language to digitise the reporting requirements in a transparent, standardised and cost-effective way.

KPMG has outlined regtech as a ‘particularly hot sector in the EMEA region in the last few months’, with programmes like DRR demonstrating that it will continue to lead the way in financial innovation throughout 2023.

Peter Ku, vice president and chief global strategist, Informatica

In 2023, we’ll see a marked shift from human-led activity to a greater reliance on AI and machine learning technologies within financial services organisations. This will be most prevalent in two areas – data management and governance.

Financial services organisations will adopt data fabrics and data mesh at scale as they look to operationalise data, solve quality issues and improve compliance. Gartner predicts that data fabric deployments will quadruple efficiency in data utilisation while cutting human-driven data management tasks in half.

Human intervention will be lower in the areas where automation can do the heavy lifting, helping speed decision-making, reduce error and improve efficiencies. But we’ll see a significant uptick in using data by the line of business teams tasked with delivering seamless customer experiences, making informed decisions on issuing loans, negotiating insurance packages, and detecting fraud. Enabling this will require self-service data governance – delivering trusted, high-quality data to the right teams, right at the moment they need it, all in a fully governed and compliant way. Chief Data Officers (CDOs) will be tasked with supporting less centralised data governance programs and ensuring it is tightly coupled with business priorities.

The challenging global economic climate is placing increased focus on reducing cost – but financial services organisations cannot cut corners. Instead, CDOs should look to leverage data management solutions that bring the power of AI and [machine learning] to bear to scale their data governance policies and processes while reducing the cost incurred by human-led effort, who can instead look to leverage data to innovate and drive value for the business.

Arunabh Madhur, regional VP and head of business EMEA, SHAREit Group

As consumer demand for greater convenience grows stronger, we expect to see mobile payments explode even more next year. Customers have become increasingly comfortable with making digital payments which is helping to fuel the growth in multiple verticals, such as ecommerce, social, foodtech, gaming etc. In the near future, flexibility and innovation around payment options will continue to enhance the customer experience.

Digital payment methods, which enable card payments via smartphones, have not only streamlined the customer journey but also facilitated to drive the digital and financial inclusion for the large unbanked population in emerging markets. With digital wallets becoming a core part of payments and online shopping experiences, mcommerce transactions will also continue to grow. The growth will evidently expand into 2023 and beyond and for companies who wish to benefit from such growth, it is vital that they adapt to the digital payment changes to ensure future success.

Lars Seier Christensen, founder, Saxo Bank

The current washout is equivalent to the Dotcom Crash of 2001, after which the real internet revolution accelerated.

The current innovations in the DeFi space holds great potential for the TradFi industry, but is marred by a lack of regulation and too many dubious and incompetent actors. Cleaning up this space and reducing the FOMO and cash grab motivation will open for real partnerships and opportunities between the old and the new world.

Tokenisation will accelerate and begin to show how many more assets can be offered efficiently to a broader investment public than is the case today.

Instant transfers with new and trustworthy stablecoins, backed 1:1 by assets and issued by credible players, are another great opportunity for making payments much more efficiently than what we know today in TradFi.

Better inclusion of currently unbankable clients is a large opportunity, but needs to happen in a regulated environment. Regulation will accelerate in 2023 and the next years, creating a more solid foundation for such initiatives.

Portable ID/KYC that we work on at Concordium will make for easier onboarding and safer interactions in the developing Web3 space.

Both the old and new world in finance can benefit enormously from collaboration and I think we will begin to see more examples of this in 2023.

Merlin Piscitelli, Datasite CRO, EMEA

With global technology company valuations and investments down in the last 12 months, and the technology industry’s new focus on profit generation, especially among startups and mid-sized companies, the fintech sector is likely to experience some consolidation in 2023.

Rather than fighting and competing against each other or looking for investment and acquisitions from bigger companies, smaller fintech companies will look for opportunities to collaborate to compete globally including, pursuing joint ventures to reduce operational costs. What was previously driven by finance, will now become more about synergies.

Paul Marcantonio, executive director UK & Western Europe, ECOMMPAY

An emerging fintech growth space, the metaverse, will bring additional function and fun into the world of payments in 2023. We can expect to see innovations in cryptocurrencies and blockchain applications that will be more appealing to the digitally sophisticated audience of early adopters. But there will also be opportunities to utilise payment methods that have been working outside of the metaverse, such as open banking and BNPL.

Any metapayment method explored needs to technically accessible so that there are clearly defined links to traditional currency. But as long as transactions are instant, not close to real-time the payment options will be viable. Metapayments will bring the concept of the consumer to a whole new level in the next few years. The possibilities are endless.

Wissam Khoury, EVP, Treasury & Capital Markets, Finastra

The pandemic, global conflicts, economic and political uncertainty: in the last few years, we’ve witnessed an increased frequency of extreme events that have impacted financial services and placed more strain on a bank’s balance sheet. Additionally, we are seeing fast-changing regulations and increasing cost pressures, meaning banks have to increase their ability to adapt to new demands while decreasing their total cost of ownership.

As these events continue to impact financial services. In 2023 we expect to see an increased importance of the role of the treasury and banks embracing digital transformation to remain relevant. By phasing out their legacy technology and moving their operations into a cloud environment, banks can adapt quicker to ongoing uncertainty and future-proof their investments through systems and solutions that provide the agility, adoption rate and functionality to meet regulatory deadlines. They can also reduce costs, scale their business and improve functionality with faster upgrades and enhanced services.

In 2023, we expect to see a continued shift in the treasury’s mindset from ‘build’ to ‘buy’. Banks are increasingly buying the latest solutions from specialist fintechs instead of developing them in-house, but we expect to see particular growth in the ‘as-a-Service’ subscription model due to its myriad benefits.

By purchasing and deploying fully managed solutions which provide functional and technical enhancements in their core, banks can become a future-ready, integrated platform with increased agility and lower TCO through tech stack modernization and deployment. There will be increased connectivity with ecosystems which allow banks to implement, via APIs, specialised fintech applications which accelerate the rollout of regulatory requirements.

Robert Prigge, CEO, Jumio

The financial services industry is at a turning point, where the global economy is shifting to authorising purchases and other transactions based on user identity rather than credit card numbers.

Consumers are increasingly leveraging biometric authentication to access their saved credit card information, banking apps and digital payment methods, like Apple Pay. As consumers increasingly use their identity to access and complete transactions in 2023, it’s likely we’ll see the number of transactions completed with digital identities surpass those of credit cards.

Daniele Servadei, CEO and co-founder, Sellix

In 2023, I expect to see a 50% increase in fintech product sales across the world. Many fintech firms will fail amid market and customer movements, but many others will grow and take their place. Cryptocurrencies will start taking more and more ground as available payment methods. Fintech providers will also invest heavily in UI and UX in a bid to increase their competitive advantage.

Venkatesh Varadarajan, partner, Infosys Consulting

The globalisation of banking is opening finance up to a whole variety of new fraud situations. Increasingly, consumers can move finances online between standalone bank accounts in different countries, but this heightens the risk of money laundering and financial crime.

In 2023, we’ll see more banks attempt to combat this by adopting tools that enable the earlier detection of suspicious activity in transactions. AI and machine learning tools have already seen a lot of traction post-Covid and during the economic bounce back. However, adoption will become more widespread as banks look to conduct data-backed sense checks which can identify causes and ensure the detection of fraud much earlier in the lifecycle.

Both banks and insurance firms will continue to beef up operational, security and technology remediation activities to better identify potential risks. This means more audits of various processes, including legacy technology and disaster recovery. As threats increasingly target these business-critical areas post-Covid, we’ll see more programmes being driven under direct guidance from leadership, and teams bolstered by SMEs and external support.

BNPL is here to stay. It’s cemented itself as a new payment method, offering a flexible, faster way for consumers to purchase items. In the past year, we’ve seen UK banks like NatWest, HSBC, Monzo and Virgin Money all launch BNPL products, to increase appeal amongst younger customers where demand for the service is high. In 2023, we’ll see the bigger players move from strength to strength in this area, buoyed by consumers typically gravitating towards more established banks during economic uncertainty.

This isn’t to say smaller players like Klarna will suffer. In 2023, we can expect the tussle between the two sides to continue. As the cost-of-living crisis continues, a key challenge is ensuring consumers don’t overspend and fall into debt. Bigger banks have an upper hand as they can access rich customer data based on multiple transactions, credit cards and mortgages.

On the other hand, fintechs like Klarna and Clearpay are far nimbler and quicker at mining this information. Both sides will need to better utilise these capabilities, as it’s likely more regulation will be introduced in 2023 requiring firms to check customers can afford to use their products.

The metaverse is still a relatively small market, but it’ll grow substantially over the next decade—forecasts suggest by almost 40% yearly between 2022 and 2030. A lot of banks are already using the metaverse for training purposes, but it has huge potential to enhance the customer experience and excite customers to bank and shop for new products. Virtual banking is a growing space and can help keep banking costs down, reducing the need for physical space and enabling branch optimisation.

Big Tech is already placing large stakes in this, and the intersection of tech and financial services will accelerate over the next few years. Major players like Meta, APPL, and Amazon all have a deep understanding of customer behaviour. They will use this data to wire up consumers in various ways and financial services are a critical component of this.

In terms of regulation, it’ll be smaller rules coming in that impact other channels, rather than big-ticket ones that we see in capital markets or investment banking. Like we’ve seen with certain sets of regulations introduced off the back of branch openings, then contact centres, then the internet and most recently mobile banking, the metaverse will be the next stage in this process as we look to virtual banks.

Capital markets activity will continue to grow despite market volatility as more consumers invest in stocks and Isas. Previously, the customer base in capital markets was very institutional in nature. However, the pendulum has swung, especially towards younger generations, thanks to the accessibility and ease of stocks and shares platforms online and consumers sitting on more savings from lockdown which they are willing to invest.

These platforms have not only increased awareness and knowledge around investing, but low or zero fees charged have made it far easier to invest smaller sums of money. We’ll see momentum with capital markets activity continuing into 2023 and beyond as younger consumers look to grow their investments in the long term.

Campbell Shaw, SVP of FI and publisher partnerships, Cardlytics

Times of economic downturn are often the catalyst for change and transformation, and this will be no different for fintechs in 2023.

As we see a continuation of the trend towards high street branch closures and fewer face-to-face interactions, with businesses look to save money and drive efficiencies, we’ll also see more banks leveraging analytics to improve engagement.

Capitalising on this data will be key for banks increasingly shifting operations online as they still look to deliver strong customer experiences and instil confidence for their users.

Whilst leveraging spending insights will give banks a more informed view of customer situations and preferences, this shouldn’t be used to assume we know the whole picture. This data should be used as a jumping off point to start conversations with customers, taking personalisation on a case-by-case basis and listening to their needs rather than dictating solutions based on raw numbers.

2023 will also be a big year for the entire ecosystem as banks will be seeking further cooperation between themselves and fintechs.

In order to rapidly innovate and transform their offering, banks will need to rely more heavily on the solutions fintechs offer in order to provide new services at a much faster rate than, for example, spending the best part of a decade developing solutions themselves.

A ‘plugged in platform’ environment can enable frictionless data sharing between platforms and customers on behalf of the banks – allowing them to respond quickly to changing needs.

That said, much of this information sharing will rely on accelerating the progress we’ve seen since open banking was introduced five years ago. Unless this continues to move forwards, banks and fintechs will continue to run into the same stumbling blocks, such as a lack of data interoperability, that stifle innovation across the industry.

Henrik Rosvall, CEO and co-founder, Dreams Technology

To say that 2022 has been a turbulent year is quite an understatement. While the energy crisis has driven high levels of inflation, causing people around the world to face higher costs of living, banks are now bracing for even tougher economic conditions and a possible global recession in 2023.